In mid-2025, tensions between the United States and Canada intensified over Canada’s proposed digital services tax (DST), sparking strong criticism from former U.S. President Donald Trump and leading to a temporary pause in trade negotiations.

What Is Canada’s Digital Services Tax?

Canada’s digital services tax is a proposed 3% levy on revenues earned from Canadian users by large technology companies. It is designed to target firms generating significant revenue through online advertising, marketplace services, or monetizing user data in Canada but paying relatively low corporate income tax there.

According to Canada’s Department of Finance, the tax applies to companies with global revenues of at least €750 million (approximately USD $800 million) and Canadian revenue from in-scope digital services exceeding CAD $20 million (about USD $14.6 million) per year.

Officials say the DST ensures companies pay “their fair share of taxes” where they do business, even without a major physical presence.

Why Is It Controversial?

A major point of contention is the DST’s retroactive scope, applying to revenues dating back to 2022. This means companies such as Amazon, Meta, Google, Uber, and Airbnb could face large retroactive bills.

Canada argues that retroactivity is justified because it paused implementation while awaiting an OECD-led multilateral solution. That global negotiation, known as Pillar One of the Inclusive Framework on Base Erosion and Profit Shifting (BEPS), has faced repeated delays.

Canada and other countries have committed to withdrawing national DSTs once a global deal is in place. However, with talks stalled, unilateral taxes have been introduced or threatened in multiple jurisdictions.

U.S. Reaction and Trump’s Criticism

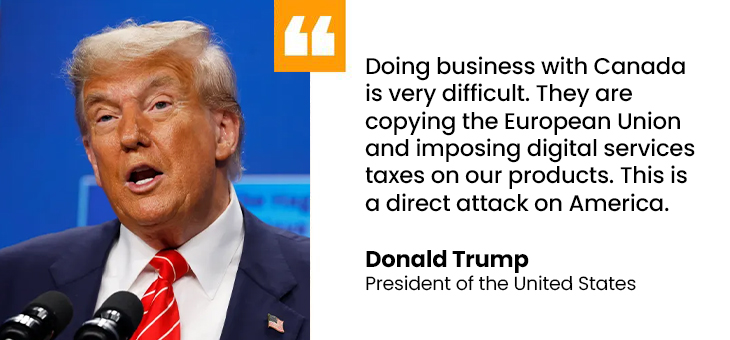

In late June 2025, Donald Trump reacted strongly after Canada confirmed plans to enforce the tax retroactively.

He described Canada as “a very difficult country to trade with” and called the DST a “direct and blatant attack” on the U.S. in a post on Truth Social. He also criticized Canada’s dairy tariffs, which have historically been among the highest in the world under its supply management system, sometimes exceeding 300%–400% on certain imports.

Such dairy disputes are a longstanding feature of U.S.–Canada trade talks, including during negotiations for the United States–Mexico–Canada Agreement (USMCA).

The Scale of U.S.–Canada Trade

Trump also announced the U.S. would suspend ongoing trade discussions with Canada and threatened new tariffs within a week.

This was notable given the scale of the bilateral relationship. According to the Office of the United States Trade Representative (USTR), in 2023, trade in goods and services between the two countries exceeded USD $762 billion, making Canada the United States’ second-largest trading partner after Mexico.

Canada’s Official Response

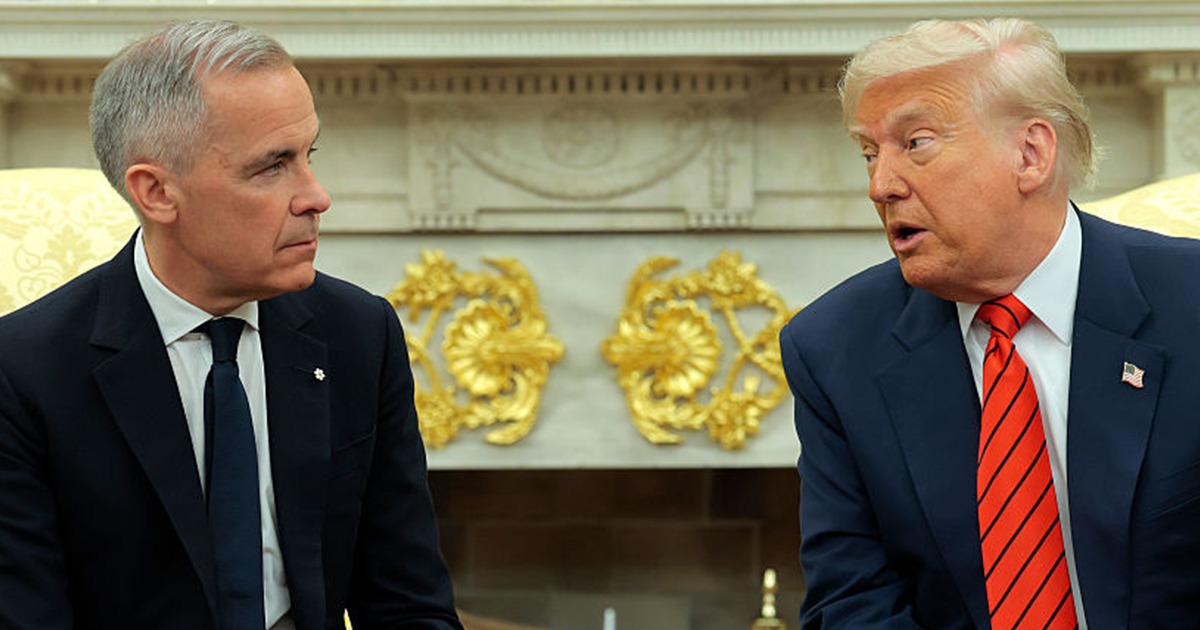

Prime Minister Mark Carney, who took office earlier in 2025, responded that Canada would continue negotiations “in the best interests of Canadians.”

Carney, a former Bank of England governor and Bank of Canada governor, emphasized that Canada’s DST is a temporary measure pending an OECD agreement and that Ottawa remains committed to working toward a multilateral solution.

U.S. Lawmakers’ Objections

Beyond Trump’s comments, several U.S. lawmakers have formally objected to Canada’s plan.

In December 2023, more than 30 members of Congress signed a bipartisan letter to the U.S. Trade Representative warning that the proposed Canadian tax would “disproportionately target U.S. firms” and set a harmful precedent.

Both Democratic and Republican administrations have maintained that unilateral DSTs unfairly single out large American technology companies.

Resolution and Temporary Suspension

Following public escalation in late June 2025, senior Canadian and U.S. officials held discussions to de-escalate the dispute.

On June 29, 2025, Canada announced a temporary suspension of its planned DST collection. The government said this pause was “in anticipation of a mutually beneficial trade agreement with the United States,” just before the first retroactive payments were due.

The move aimed to support continued negotiations toward the timeline discussed at the G7 Leaders’ Summit in Kananaskis earlier in June, which had set a target date of July 21, 2025, for resolving the matter.

Outlook for U.S.–Canada Trade Relations

Despite the sharp rhetoric, trade experts suggest the suspension indicates both countries want to avoid escalating into a full trade conflict.

Canada and the United States have historically resolved disputes through formal negotiation and dispute-resolution mechanisms under agreements such as USMCA. However, the episode highlights continuing tensions over how to tax large multinational technology companies, balancing national tax policy with international commitments.

The outcome of OECD-led negotiations will be especially important. More than 140 jurisdictions are working to finalize a multilateral framework to replace national DSTs with a unified system for taxing large firms’ profits.

Conclusion

The dispute over Canada’s digital services tax underscores the challenges of modern tax policy in an increasingly digital global economy. While both sides exchanged harsh words in June 2025, the decision to suspend the tax suggests they are willing to keep negotiating.

A durable solution will likely depend on the success of OECD talks and both countries’ willingness to compromise to maintain one of the world’s largest bilateral trade relationships.

Sources:

-

Government of Canada – Department of Finance: Digital Services Tax

-

Office of the United States Trade Representative: Canada

-

United States Trade Representative – USMCA Dairy Dispute Panel: Press Release

-

U.S. House Ways and Means Committee: Statement on Canada’s DST

-

OECD: Inclusive Framework on BEPS

-

CBC News: Canada suspends planned digital services tax